CFP Board Standards of Conduct

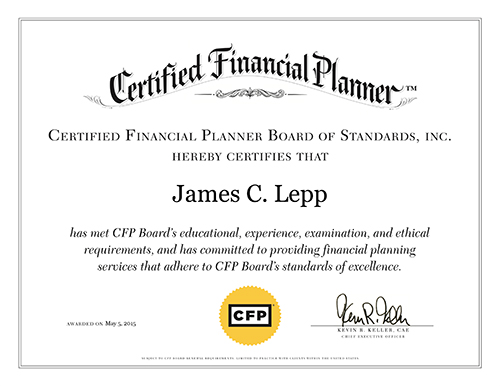

CFP Board’s ethical standards and their enforcement are an important element of the public’s trust and confidence in CFP® professionals. The standards of conduct integral to Trinity Financial Planning are exactly as defined by the CFP Board. Those standards are listed verbatim below.

- The CFP Board is a certification and standards-setting organization founded in 1985 that benefits the public by establishing and enforcing education, examination, experience, and ethics requirements for CFP® professionals. CFP Board has exclusive authority to determine who may use the CFP®, Certified Financial Planner™, and certification marks (the CFP® marks) in the United States. CFP Board conditions the permission it grants individuals to use these marks on their agreement to abide by certain terms and conditions specified by CFP Board, including those set forth below.

- As part of the CFP® certification process and the terms and conditions imposed upon CFP® professionals, Candidate for CFP® certification and Professionals Eligible for Reinstatement, CFP Board maintains professional standards necessary for competency and ethics in the financial planning profession. Through its Code of Ethics and Professional Responsibility (Code of Ethics), CFP Board identifies the ethical principles CFP® professionals should meet in all of their professional activities. Through its Rules of Conduct, CFP Board establishes binding professional and ethical norms that protect the public and advance professionalism. CFP Board’s Financial Planning Practice Standards (Practice Standards) describe the best practices expected of CFP® professionals engaged in financial planning and refer to those sections of the Rules of Conduct that provide ethical guidance. Through its Disciplinary Rules and Procedures (Disciplinary Rules), CFP Board enforces the Code of Ethics, Rules of Conduct, and Practice Standards and establishes a process for applying the Standards of Professional Conduct to actual professional activities.

- CFP Board’s predecessor organization, the International Board of Standards and Practices for Certified Financial Planners (IBCFP) introduced the first Code of Ethics in 1985. Revisions were made in 1988, including the introduction of the first Disciplinary Rules and Procedures. The next major revision, in 1993, established the Principles and Rules of the Code of Ethics. The Board of Practice Standards began work on the Practice Standards in 1995 and the standards were first published in 1999. The Practice Standards were finalized in 2002, and in 2003 the 400 series in the Rules was revised. This revision of the Code of Ethics, Rules of Conduct, and Practice Standards began in 2005 and takes effect July 1, 2008.

Code of Ethics

CFP Board adopted the Code of Ethics to establish the highest principles and standards. These Principles are general statements expressing the ethical and professional ideals CFP® professionals are expected to display in their professional activities. As such, the Principles are aspirational in character and provide a source of guidance for CFP® professionals. The Principles form the basis of CFP Board’s Rules of Conduct, Practice Standards and Disciplinary Rules, and these documents together reflect CFP Board’s recognition of CFP® professionals’ responsibilities to the public, clients, colleagues and employers.

Rules of Conduct

The Rules of Conduct establish the high standards expected of CFP® professional and describe the level of professionalism required of CFP® professional. The Rules of Conduct are binding on all CFP® professional, regardless of their title, position, type of employment or method of compensation, and they govern all those who have the right to use the CFP® marks, whether or not those marks are actually used. The universe of activities engaged in by a CFP® professional is diverse, and a CFP® professional may perform all, some or none of the typical services provided by financial planning professionals. Some Rules may not be applicable to a CFP® professional’s specific activity. As a result, when considering the Rules of Conduct, the CFP® professional must determine whether a specific Rule is applicable to those services. A CFP® professional will be deemed to be in compliance with these Rules if that CFP® professional can demonstrate that his or her employer completed the required action.

Violations of the Rules of Conduct may subject a CFP® professional to discipline. Because CFP Board is a certifying and standards-setting body for those individuals who have met and continue to meet CFP Board’s initial and ongoing certification requirements, discipline extends to the rights of CFP® professional to use the CFP® marks. Thus, the Rules are not designed to be a basis for legal liability to any third party.

Practice Standards

The Practice Standards describe best practices of financial planning professionals providing professional services related to the six elements of the financial planning process. Each Standard is a statement relating to an element of the financial planning process, followed by an explanation of the Standard and its relationship to the Code of Ethics and Rules of Conduct. CFP Board developed the Practice Standards to advance professionalism in financial planning and enhance the value of the financial planning process, for the ultimate benefit of consumers of financial planning services.

Disciplinary Rules

The Disciplinary Rules describe the procedures followed by CFP Board in enforcing the Rules of Conduct. The Disciplinary Rules provide a fair process pursuant to which CFP® professionals are given notice of potential violations and an opportunity to be heard by a panel of other professionals.

Fitness Standards for Candidates and Professionals Eligible for Reinstatement

The Fitness Standards for Candidates and Professionals Eligible for Reinstatement describe the specific character and fitness standards for candidates for certification to ensure an individual’s conduct does not reflect adversely upon the profession or the CFP® certification marks.